There are two types of price floors.

Binding vs non binding price floor.

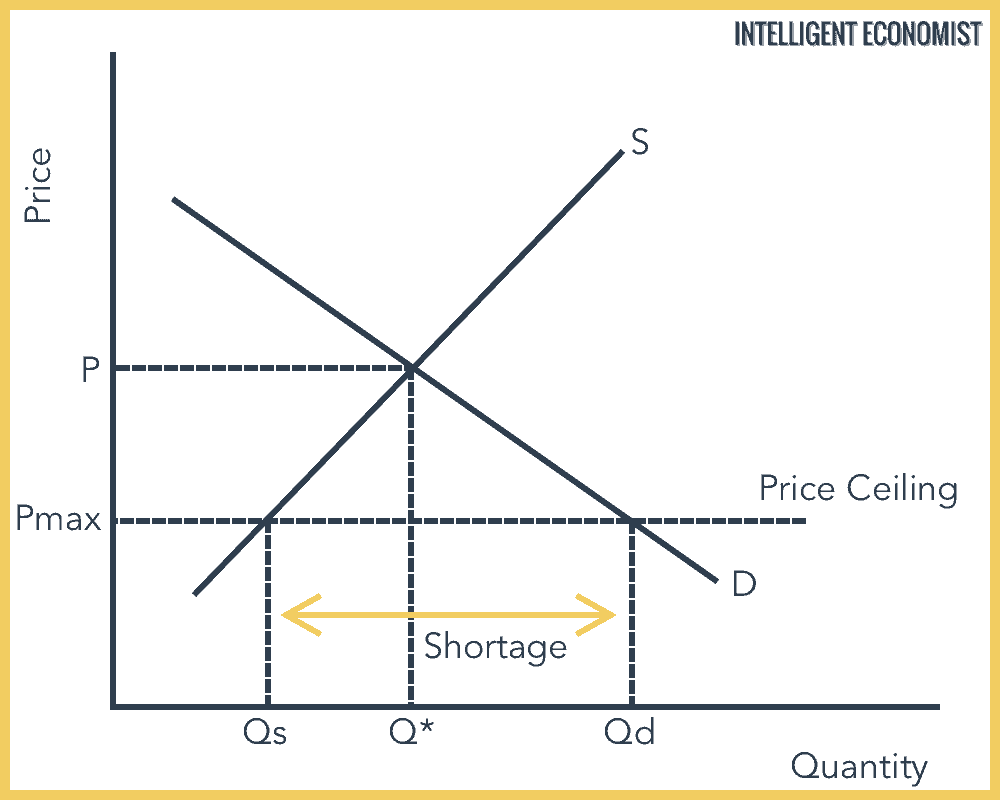

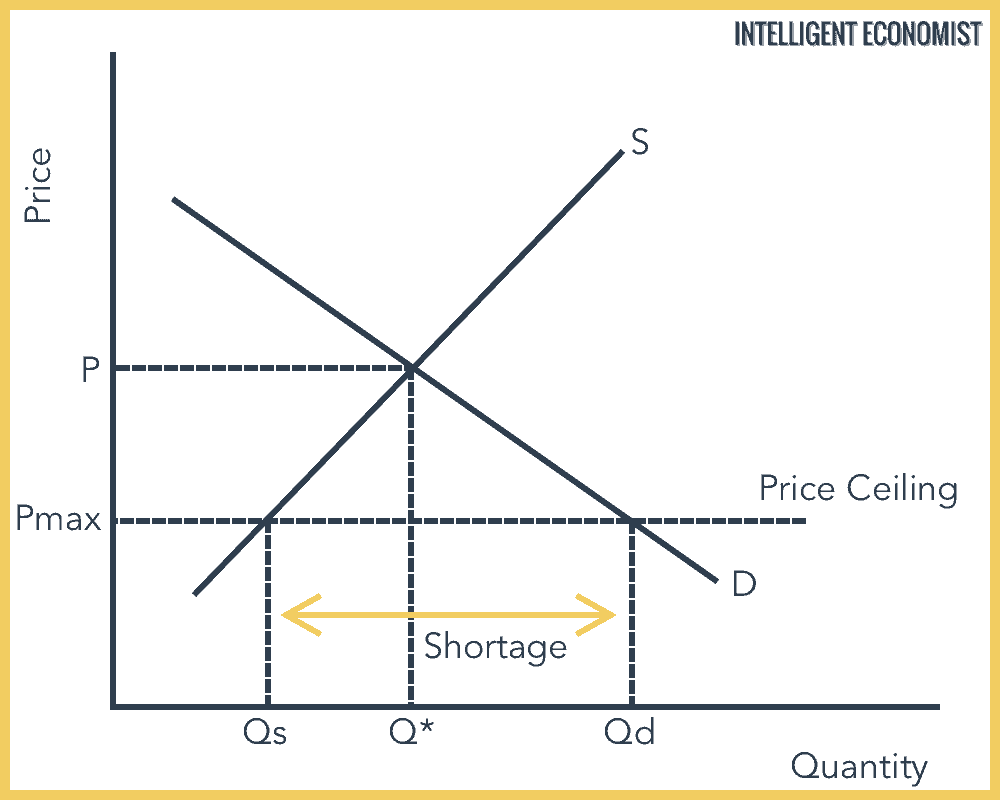

Another way to think about this is to start at a price of 0 and go up until you the price ceiling price or the equilibrium price.

If the equilibrium price is already lower than the price ceiling the price ceiling is ineffective and called a non binding price ceiling.

A price floor or minimum price is a lower limit placed by a government or regulatory authority on the price per unit of a commodity.

This is a price floor that is less than the current market price.

Note that the price ceiling is above the equilibrium price so that anything price below the ceiling is feasible.

The equilibrium market price is p and the equilibrium market quantity is q.

A non binding price floor is one that is lower than the equilibrium market price.

Consider the figure below.

A price floor is a form of price control another form of price control is a price ceiling.

This is an example of a non binding or not effective price ceiling.

For a binding price floor or ceiling picture them as the opposite picture a house with a floor and a ceiling now the lay the supply and demand graph over it.

Note that the price floor is below the equilibrium price so that anything price above the floor is feasible.

Another way to think about this is to start at a price of 100 and go down until you the price floor price or the equilibrium price.

Graphical representation of tax on buyers and tax on sellers.

The government establishes a price floor of pf.

For example suppose that the prevailing equilibrium price was 100 still and the government set the price ceiling to be 130 the price would still be 100 not 130.

If the price floor is under the equilibrium price economic effects of rent control and minimum wage short run long run per unit tax on buyers sellers and market outcome.